Penguin Random House Editor’s Buzz

Check out some of Penguin Random House’s Galleys Here! Whitney Frick, Editorial Director at The Dial Press Katy

Check out some of Penguin Random House’s Galleys Here! Whitney Frick, Editorial Director at The Dial Press Katy

Blo Blow Dry Bar Opens Newest Bar at the St Johns Town Center

Grand Opening Party & Pink Ribbon Ceremony scheduled for Nov. 5, 2022, from 3pm to 7pm.

Grand Opening Party & Pink Ribbon Ceremony scheduled for Nov. 5, 2022, from 3pm to 7pm.

JACKSONVILLE, Fla. – …

What to Do if You Can’t Afford Your Car Repair Bill

NEW YORK – October 28, 2022 – (Newswire.com)

iQuanti: When disaster strikes, the last thing you want is to be unprepared, but it is becoming a reality for more and more Americans. With rising costs for materials and labor, you may be shocked to find you can’t afford your next car repair bill.

In those situations, it’s important to have backup options for funds so that the necessary expenses are covered. Next time you’re in a pinch, consider these choices for upcoming or surprise car repair and maintenance.

Get a personal line of credit

In a pinch, a line of credit can be extremely helpful. Extremely similar to credit cards, a person is able to access up to a pre-determined amount of funds within a credit limit. You’ll only want to take what you need as, just like a credit card, you’ll owe interest on the amount you’ve borrowed. While there is flexibility to pay back the funds, it’s important to be wary of how interest can accrue the longer the balance is outstanding.

Borrow from family and friends

One of the easiest and least complicated methods to obtain money in a pinch is to ask for help from loved ones. Sure, not everyone has the luxury of accessing money from family and friends or necessarily wants to, but if you can, it may provide a more flexible method of repayment.

Plus, you can skip the fees and only borrow and repay the amount that you’ve borrowed. But if money is a sensitive subject in your family or social circle, it may be smart to avoid this method unless absolutely necessary when no alternatives are available.

Get an installment loan

Installment loans come in handy when you need a manageable repayment schedule with stable interest. With these loans, you can receive a lump sum of money all at once. Then, you’ll pay it back over time in fixed monthly payments, or installments. Repayment terms can last from a few months to several years. The benefit of these is that you’ll have all the information you need to properly repay the loan from the beginning.

Use a credit card

Credit cards are a huge tool for unexpected expenses, so long as you have one in place prior to the expense. Something important to note with a credit card is that there is usually a credit limit that maxes out the amount you can spend.

For new credit borrowers, that amount could be minuscule, such as $1,000 or less, especially in the case of secured cards. On the other hand, seasoned borrowers or those with favorable borrowing characteristics may be able to access tens of thousands in credit. For high expenses like home repair or unexpected medical bills, this can help keep you afloat.

The bottom line

Car repairs, like any emergency expense, can provide unnecessary financial stress on top of the burden this life event causes. In order to be prepared, you’ll want to make sure you have access to cash or have the means to get more funds, whether it be a loan or other option.

Contact Information:

Keyonda Goosby

Public Relations Specialist

(201) 633-2125

Carolina Darbelles

Senior Public Relations Specialist

(201) 633-2125

Press Release Service

by

Newswire.com

Original Source:

What to Do if You Can’t Afford Your Car Repair Bill

My Creative Studios Presents Salon Suites for Rent in Orlando, Florida

These salon suites are perfect for any hair stylist, makeup artist, or esthetician looking for a prime location to start their business.

These salon suites are perfect for any hair stylist, makeup artist, or esthetician looking for a prime location to start their business.

…

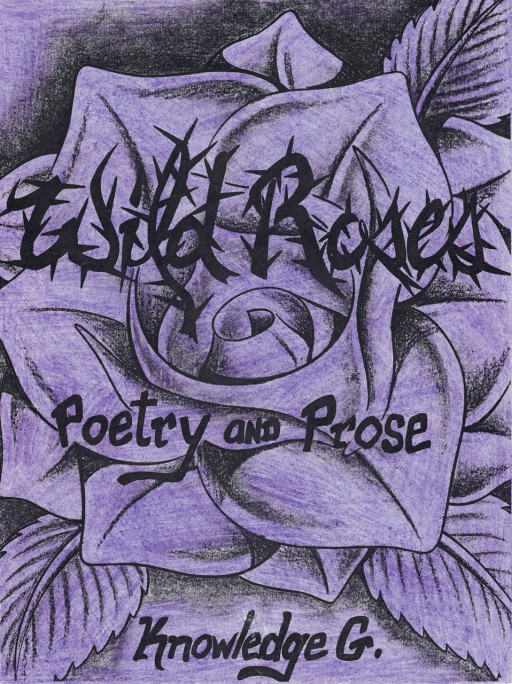

New Poetry Collection Praises Womankind

Wild Roses

Wild Roses

PORT ANGELES, Wash. – October 28, 2022 – (Newswire.com)

…

BioDerm, Inc. Begins Distribution in Home Care Markets of a New Revolutionary Female Incontinence Device From TillaCare, Ltd

BioDerm, Inc., a leading provider of disposable medical devices and wound care supplies, announced a new distribution deal with TillaCare Ltd, an Israeli designer and manufacturer of external urine collection devices.

…

How to Maximize Your Salary as a Nurse

NEW YORK – October 28, 2022 – (Newswire.com)

iQuanti: The average salary…

What to Do if You’re Short on Cash in Your Retirement

NEW YORK – October 28, 2022 – (Newswire.com)

iQuanti: If you’re like many people, you may have dreamed of retirement as a time when you can finally relax and enjoy your golden years. But the reality is that retirement can be a stressful time, especially if you’re short on cash. Don’t despair! There are plenty of things you can do to make ends meet, even if you’re on a tight budget. Here are a few ideas to get you started:

1. Cut back on unnecessary expenses

One of the easiest ways to save money in retirement is to take a close look at your spending and cut back on unnecessary expenses. Do you really need that fancy coffee every day? Could you travel or eat out less often? Even small changes can make a big difference in your retirement budget.

2. Sell some of your stuff

Chances are, you may have a lot of stuff that you don’t really need. Why not sell some of it to free up some extra cash? You can have a garage sale, sell items online, or even donate them to a thrift store.

3. Get a part-time job

Retirement doesn’t mean you have to stop working altogether. If you need some extra money, consider getting a part-time job in retirement. There are plenty of jobs that are perfect for retirees, such as teaching, consulting, or working in a retail setting.

4. Make some home improvements

Making some simple home improvements can also help you save money in retirement. For example, you could weatherize your home to make it more energy-efficient. Or, you could install solar panels to reduce your electricity bills.

5. Get an unsecured line of credit

An unsecured line of credit can be a great way for retirees to get extra cash when they need it. You can use the money for anything you need, and you don’t have to put up any collateral. Better yet, you can pay this loan back all at once or over time, and you’ll only pay interest on the amount you borrow.

6. Downsize your home

If you’re finding that your current home is too expensive to maintain, downsizing to a smaller home can be a great way to save money in retirement. Not only will you have lower monthly expenses, but you’ll also have less stuff to take care of.

7. Live in a retirement community

Moving into a retirement community can be a great way to cut down on your living expenses. Retirement communities typically include amenities like meals, transportation, and activities, which can help you save money.

The bottom line

No matter what your retirement budget is, there are plenty of ways to make ends meet. By cutting back on unnecessary expenses, selling some of your stuff, and getting a part-time job, you can free up some extra cash. An unsecured line of credit can give you flexible access to funds so you can cover the expenses you need. And if you’re really struggling, downsizing your home or moving into a retirement community can be a great way to save money in the long run.

Contact Information:

Keyonda Goosby

Public Relations Specialist

(201) 633-2125

Carolina Darbelles

Senior Public Relations Specialist

(201) 633-2125

Press Release Service

by

Newswire.com

Original Source:

What to Do if You’re Short on Cash in Your Retirement

Author Anton D. Morris’s New Audiobook ‘Exposed: Humanity Craves Power’ is a Thought-Provoking Tale That Explores How a Secret Society is Pulling the Strings in America

Recent audiobook release ‘Exposed: Humanity Craves Power’ from Audiobook Network author Anton D. Morris is a fascinating and gripping story centered around an influential underground society that bolsters its members to become powerful political figures in America. As member Horus begins his presidential campaign, an inquisitive reporter will try to discover what exactly he’s hiding.

PFLUGERVILLE, Texas – October 28, 2022 – (Newswire.com)

Anton D. Morris has completed his new audiobook “Exposed: Humanity Craves Power”: a spellbinding and politically charged tale that weaves an intricate narrative centered around a secret underground society that runs the United States from behind the scenes.

“A presidential candidate and his wealthy, influential family must navigate scandal and politics when the public learns that he is a member of a secret society created by slave owners,” writes Morris.

“Horus is the latest in a line of men in his family to join a secret society originally created by slave owners. Handpicked by the head of the society, Horus is now running for the Republican nomination for president. He has no political experience, but his family runs a successful management firm, so he comes to the job as a businessman with inherited wealth.”

Published by Audiobook Network, author Anton D. Morris’s new audiobook is a thrilling journey exploring the greed and corruption that works behind closed doors to keep powerful men and women who run the county in control of the masses. Raw and eye-opening, “Exposed: Humanity Craves Power” will dare listeners to question their own beliefs and stay with them long after its stunning conclusion.

Listeners can purchase the audiobook edition of “Exposed: Humanity Craves Power” by Anton D. Morris through Audible, the Apple iTunes store, or Amazon.

Audiobooks are the fastest-growing segment in the digital publishing industry. According to The Infinite Dial 2019, 50% of Americans age 12 and older have listened to an audiobook. This huge growth can be partly attributed to increased listening in cars, which surpassed the home as the #1 audiobook listening location in the 2019 survey. Smart speaker proliferation also bodes well for future listening growth and more mainstream listening.

Audiobook Network, Inc. (ABN) is a full-service audiobook publishing company that transforms authors’ books or e-books to life through audio narration. ABN handles narration, production, audio editing, digital formatting, distribution, promotion, and royalty collections all under one roof. For additional information or media inquiries, contact Audiobook Network at 866-296-7774.

Contact Information:

Audiobook Network

Media Department

866-296-7774

Press Release Service

by

Newswire.com

How to Host a Halloween Party on a Budget (And What to Do if You’re Short on Cash)

LOS ANGELES – October 28, 2022 – (Newswire.com)

iQuanti: Halloween is a time to be celebrating with light-hearted fun, not panicking over affordability. Luckily, there are plenty of options available for how to host a Halloween party on a budget, and we’ve rounded up a few for you. Plus, if you’re looking for access to funds in order to make your party work, find some tips on where to find funds below.

Low-budget Halloween ideas

Throwing an epic Halloween bash doesn’t need to break the bank. In fact, it can be as manageable and inexpensive as you want it to be. If you can rope in a few friends or family to help you creatively piece together your Halloween bash, you’ll find it can be a lot cheaper than you imagined. Here are a few Halloween ideas to get you started!

Focus on the vibe

While over-the-top décor can be fun, it’s also not necessary, especially if your party is adult-centered. Small things like lighting and good music can have way more of an impact than any signs or setups you can manage. To save on both cost and time, stick to the things you know your partygoers will appreciate most rather than getting caught up in throwaway décor.

Set a theme

If you’re looking to make the atmosphere fun without putting in all of the effort alone, tell your invites that they need to dress according to the theme. You’ll be able to create a sense of cohesiveness without having to worry about much more than yourself. Sure, you can just have a general theme, but why not tell everyone to come as their favorite singer or favorite color? This places some of the focus on attendees to set the mood rather than just you!

BYO/Potluck

A bring-you-own get-together will save you major headaches and cost when it comes time to plan. To help make sure you don’t end up with twelve bags of chips and no drinks, consider having them mention what they’ll bring when they RSVP. Even easier? Create an online spreadsheet that is updated in real-time when someone claims the beverage or food they’re bringing.

What to do if you’re low on cash

Sometimes, despite your best efforts, it can be difficult to afford even a low-budget get-together. In these cases, you may consider getting a quick loan from a direct lender. With these loans, you can access money to cover your party needs and repay the funds when you’re able to, or according to the agreed-upon repayment schedule.

If you’re struggling with credit, the process of accruing a loan may be more difficult, but it is by no means impossible. Although it may be tough to find no credit check loans from direct lenders, many lenders offer less strict credit score requirements if you have poor or fair credit.

The bottom line

When Oct. 31 rolls around, don’t let party planning ruin the fun – or your wallet. With a little planning, creativity, and offloading some of the responsibility to family and friends, the day can remain stress-free and keep your wallet happy. And in the case that you want to go above and beyond but need a little extra cash, there are options available that may be perfect for your needs.

Contact Information:

Keyonda Goosby

Public Relations Specialist

(201) 633-2125

Carolina Darbelles

Senior Public Relations Specialist

(201) 633-2125

Press Release Service

by

Newswire.com

Original Source:

How to Host a Halloween Party on a Budget (And What to Do if You’re Short on Cash)